Small Business and Individual Entrepreneurship Tbilisi, Georgia

Simplifying Individual Entrepreneurship (IE) License Registration in Georgia

If you are a national looking to start your own business in Georgia, Tbilisi, the process of obtaining an Individual Entrepreneurship (IE) license can sometimes seem daunting. However, we are here to help simplify the procedure and make it easier for you to embark on your entrepreneurial journey. Our services not only include assisting with the entire registration process to become an Individual Entrepreneur at the Public Service Hall but also providing you with a legal address in Tbilisi, ensuring a smooth and hassle-free experience.

Streamlined Procedure at the Public Service Hall: Navigating the bureaucratic procedures at the Public Service Hall can be time-consuming and confusing. Our team of experts is well-versed in the requirements and documentation needed for obtaining an IE license. We will guide you through the entire process, from filling out the necessary forms to submitting the required documents, ensuring that all the steps are completed accurately and efficiently.

Assistance with Documentation: We understand that compiling the required documents can be overwhelming, especially if you are not familiar with the local regulations. Our knowledgeable team will assist you in gathering and organizing all the necessary paperwork, including identification documents, proof of legal address, and any additional documentation specific to your business activities. This ensures that your application is complete and meets all the legal requirements.

Legal Address Provision: Having a legal address in Tbilisi is a mandatory requirement for registering an IE license. As part of our comprehensive service, we provide you with a legal address that fulfills all the legal obligations. This eliminates the need for you to find and secure a separate physical address, saving you time and effort. You can choose any of legal addresses starting from 350 GEL for 12 months plan.

Expert Guidance and Support: Starting a business can be overwhelming, especially if you are unfamiliar with the local laws and regulations. Our team of experienced professionals is dedicated to providing you with expert guidance and support throughout the entire process. We will answer any questions you may have, provide clarification on legal requirements, and ensure that you are fully informed at every step of the way.

Efficiency and Time-Saving: By utilizing our services, you can save valuable time and streamline the process of obtaining an IE license. Our expertise in handling the registration procedure, coupled with our knowledge of the local requirements, allows us to expedite the process and minimize any potential delays or setbacks.

Starting a business as an individual entrepreneur in Georgia, Tbilisi, should not be an intimidating process. Our dedicated services aim to simplify and expedite the procedure of obtaining an IE license, providing you with the necessary support and expertise every step of the way. From assisting with the paperwork at the Public Service Hall to providing a legal address in Tbilisi, we are committed to making your entrepreneurial journey in Georgia a smooth and successful one. Contact us today to benefit from our comprehensive services and embark on your path to business success.

Our fees:

Legal address in Tbilisi for use with Individual Entrepreneurship license for 12 months 750 GEL (incl. 350 GEL 12 months legal address)

Our assitance in Public Service Hall to register Individual Entrepreneurship (as a part of legal address subscription): Free of charge

1% Small Business Tax Status in Georgia: Benefits, Restrictions, and Maximum Turnovers

Georgia offers a favorable tax environment for small businesses, with a special tax status that allows for a reduced tax rate of just 1%. This tax regime is designed to support and encourage the growth of small enterprises in the country. Here's what you need to know about the small business tax status in Georgia:

Benefits of Small Business Tax Status:

Restrictions and Forbidden Activities for Small Business:While the small business tax status in Georgia offers many advantages, there are certain restrictions and activities that are not eligible for this favorable tax treatment. These include:

|

. |

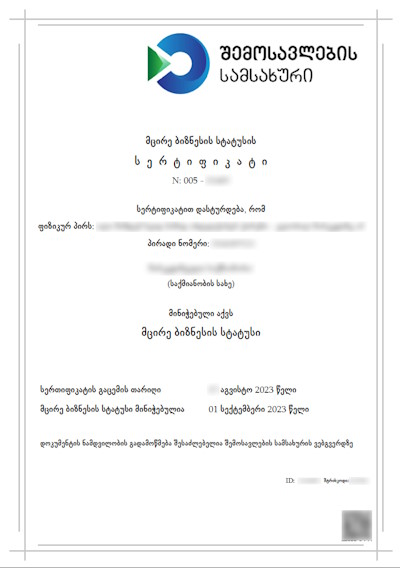

Small Business Tax certificate

|

Maximum Turnovers for Small Business:

To qualify for the small business tax status, there are maximum turnovers that a business must not exceed. The turnover thresholds are periodically adjusted by the tax authorities. As of the current regulations, the maximum annual turnovers for small businesses to benefit from the 1% tax rate are:

- For micro businesses: Up to GEL 30,000 (approximately USD 11,000) the tax is 0%

- For small businesses: Up to GEL 500,000 (approximately USD 200,000) the tax is 1%

Who is eligible for Small Business 1% tax status

- Individual Entrepreneurs whose annual turnover does not exceed GEL 500,000 in two consecutive year

- Any foreigner. Temporaly or Permanent Residence is not required.

It's important for small businesses to monitor their turnover and ensure they stay within the defined thresholds to maintain their eligibility for the reduced tax rate.

Individuals classified as small businesses in

Georgia benefit from a reduced personal income tax rate of 1% instead of the standard 20% rate. It is important to note that the small business status does not exempt individuals from Value Added Tax (VAT). VAT will still be applicable to small businesses, following the same rules as other taxpayers, once their turnover exceeds the threshold of 100,000 GEL in a 12-month period. However, if an individual provides services to foreign customers, there is a high likelihood that VAT will not apply, although this will be assessed on a case-by-case basis.

Small Business and VAT

Individuals classified as small businesses in Tbilisi, Georgia benefit from a reduced personal income tax rate of 1% instead of the standard 20% rate. It is important to note that the small business status does not exempt individuals from Value Added Tax (VAT). VAT will still be applicable to small businesses, following the same rules as other taxpayers, once their turnover exceeds the threshold of 100,000 GEL in a 12-month period. However, if an individual provides services to foreign customers, there is a high likelihood that VAT will not apply, although this will be assessed on a case-by-case basis with our team.

Our fees to active Small Business:

Our assitance at Revenue Service to register Small Business staus - the client is present in Tbilisi: 350 GEL

Our assitance at Revenue Service to register Small Business staus - remotely with Power of Attorney: 900 GEL

To register a small business in Georgia you need to follow these steps:

1. Ensure you meet the preconditions for small businesses:

- You are already registred as Individual Entrepreneur (please see the point up about IE registration)

- Your annual income, taxable under the 1% rate, should not exceed the threshold of 500,000 Georgian Lari in two consecutive years.

- Your business activities should fall under the category of "allowed activities for small business."

- Your contractual relationship with your client(s) should not be considered employment, regardless of the agreement's title.

- The Georgian tax administration (Revenue Service) should not have grounds to reclassify your transaction for tax purposes, which could lead to the revocation of the 1% tax regime.

2. Understand that the 1% tax rate in Georgia does not apply to employment income, and the title of your contract with your client(s) is not the sole determining factor. The tax administration uses a specially designed questionnaire to assess whether your contract is classified as employment or service.

3. Gather the necessary documents for Registration os Small Business, which may include:

- Personal identification documents (international passport or ID card).

- Proof of legal address that we will provide you and is included in the price of activation of Individual Entrepreneurship (IE) License Registration

- Description of your business activities (we wil assit you).

- Financial statements or supporting documents (optional).

To order Individual Entrepreneur or Small Business registration, please fill out the above form, send us an email or contact our call center on the phone (+995) 557 300 007 (also on WhatsApp, Telegram) or on the chat on the website.